This is the first in a three part series on reducing the stress of personal finance. Each of the posts will detail a simple technique to reduce financial headaches.

The Personal Escrow Account

Creating a separate savings account for irregular expenses has been the single biggest stress reliever related to my personal finances. The idea is to smooth out those irregular costs into a normal budgeted amount. It functions by setting aside money on a monthly basis, and works the same as an escrow account tied to your mortgage.

Say goodbye to those crazy months where 5 different yearly payments come due and a car repair is required. It’s accounted for in the personal escrow account and you simply transfer the money from the escrow account to your checking account as needed.

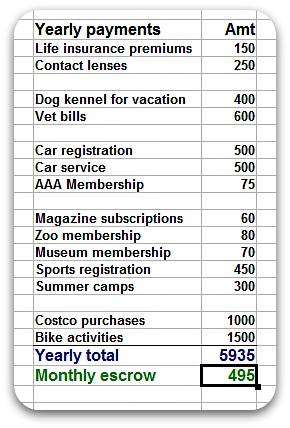

The image to the right is a sample list that includes yearly or irregular payments such as life insurance, vet bills, kid’s activities, those monster trips to Costco, and there is even a line item for cycling/outdoor activities (gotta make sure you fund your outdoor trips, gear repair, etc).

Simply write down all of your yearly payments with their amounts. Total it up and divide by 12. This will be your monthly amount to transfer over to your escrow account. Include any items that you don’t pay on a monthly basis. Clean your carpets every year? Add it to the list. Take Uncle Joe on a yearly trip to the Badlands? Add it to the list.

From the image on the right, you can see that the totals add up in a hurry, and you could be transferring $500 or more to your escrow account each month. However, remember that these are expenses you are planning to incur anyway. It’s better to spend an even $500 per month instead of some months with $200 and others with $900. If you don’t like the total, analyze your spending and see what could be cut out to reduce the escrow amount.

Making It Work

This process obviously works best if you are setup with online banking and can easily transfer money between accounts. After opening up a new savings account, setup a monthly automatic transfer from your checking to your personal escrow account. Then, when one of your irregular costs comes up, you simply transfer the proper amount from the escrow account back to your checking account.

That month referenced earlier with 5 irregular payments and a car breakdown becomes much less stressful when you have an account set aside and funded to pay for those costs.

Don’t expect the first year to be smooth sailing, but it will be much better than having nothing at all. It’s easy to forget some of the irregular payments you incur each year. My wife and I refined our list multiple times in the initial years of trying the escrow account, but we have worked out a fairly stable list of payments. If your account gets low or you forget several items, make adjustments to both your list and the amount you transfer each month to alleviate the issue from happening again.

Happy Days Are Here Again

With a personal escrow account setup and running smoothly, you can forget about irregular expenses causing headaches and arguments. You’ll be able to absorb those bumps in the proverbial road without a frown on your face.

As a final tip, please make sure you include your hobbies in your calculations so that you have money set aside to make you happy. Don’t miss out on a bike trip with friends just because you had to make your quarterly Costco run and pay for the kid’s fall soccer the week before.